In the face of market volatility, there are multiple ways that energy market participants are looking to hedge or insure their risk exposure. Our Australian colleagues at CQ Energy and their partners at Risk Solutions International have been involved in developing a range of innovative solutions for energy companies for 20+ years.

Their experience in what some describe as the ‘most volatile electricity market in the world’ is invaluable for market participants in Europe and the UK, now that we are exposed to ever increasing risks and volatility.

Here, we give a short introduction about weather derivatives and forced outage products, which serves as a baseline for an introductory webinar we organised in November 2022, a recording of which you can watch below:

Who should watch our webinar?

Historically we see that weather risk management consisted of a mix of ‘blaming the weather’, hedging in related commodity markets and/or passing on the risk to clients or suppliers. Our webinar aims to show you that weather is a risk that can be actively managed! In addition, we’ll talk you through financial products which are purchased by generators to manage the risk of losing generation capacity as an alternative to self-insuring or buying through another generator. We’ll go over methods and financial products that can help you manage these risks.

There is a wide audience that could benefit from our webinar on these topics. The first category consists of generation asset owners such as solar farms, wind farms, hydro and thermal facilities. However, there are also energy traders, energy retailers and fully integrated energy companies that may want to use these financial instruments to hedge weather or outage related risks.

What are weather derivatives?

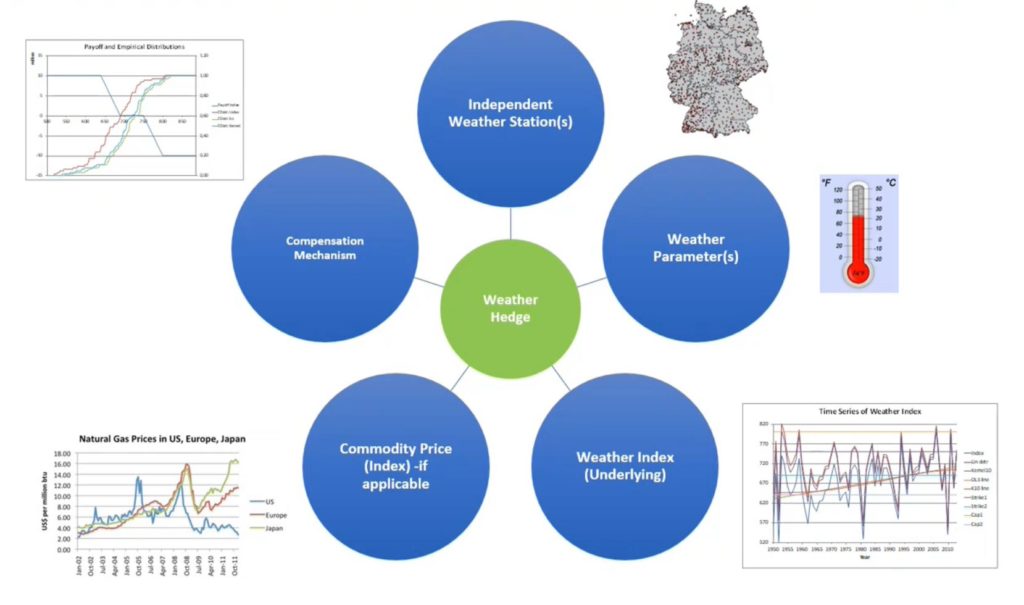

Weather derivatives are financial instruments which buyers use to mitigate energy price risks related to temperature, demand, solar, wind and precipitation events. Weather derivatives take the form of traditional financial market derivative instruments, such as put and call option contracts, and enable strategies such as collar options (buying a downside put and selling an upside call).

The difference between a typical option traded in the power markets and a weather derivative is the requirement for some form of weather trigger with a daily limit (max. daily payout) and a term limit (i.e. the maximum payout over the contract term).

The weather derivatives we work with are generally bespoke, to cover a specific risk. What makes them interesting for buyers versus standardised financial products is the flexibility they offer and their affordability, because they generally trade at a discount versus standardised derivatives. It’s not just an exotic treatment of a risk but offers a viable way to manage risks related to certain (extreme) weather events.

In addition to these products are synthetic PPAs. These are similar to traditional PPAs except they are settled on proxy generation and not actual generation. Sellers will manage price, volume and shape risk (the latter two driven by weather outcomes) but not mechanical risk which sits with the project. These will be touched on as part of the webinar.

How can we apply these learnings to European markets?

We mentioned that historically weather risk was forecasted and managed by diversification and passing on the costs to other partners in the value chain. To really move towards modern day weather risk management, there are a few requirements which are summarised in the graph below:

We see that these boxes can be ticked in Europe, where the market liberalisation has spawned a healthy and wide ecosystem of weather data providers, risk analytics and forecasting solutions, market participants and exchanges.

Discover more: Forced Outage Products

Another product which could be interesting to European energy companies is Forced Outage Products.

Forced Outage Products provide price protection to power generators when there is a loss of generation capacity while there is price volatility or revenue impact. These products cover loss due to mechanical failure, including start-up failure for example, and can cover exposure to spot prices or capacity credits. As with weather derivatives, these products have a term limit (= max payout throughout the contract term).

These are more cost-effective than purchasing insurance from other generators, since the seller will need to keep capacity in reserve to manage these forced outage events, and again come at a discount to standard market/capacity products.

To summarise, there is a clear opportunity to actively explore the benefits of these financial products with different stakeholders. We can give risk managers, traders and originators more tools at their disposal to manage weather risks in Europe, by adapting the proven formulas that have been working in Australia for two decades.

If you missed our webinar you can rewatch a recording via the link below: